Curious Corner

Quarterly Insurance Market Insights

First Quarter 2024

A Note From Our President

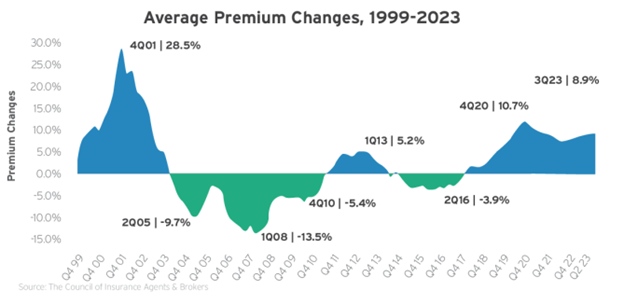

The start of a new year always brings a fresh opportunity to take a look at where we’ve been – and the commercial insurance industry has been a bit of a rollercoaster over the last five years.

While 2023 conditions eased for certain lines of coverage, the overall insurance marketplace remains unstable. We’ve seen new capacity and improved underwriting results with Directors and Officers, Employment Practices Liability, and Workers’ Compensation. On the other hand, Commercial Property, Auto, and Personal Lines experienced double-digit rate increases. Our view is that 2024 will look a lot like 2023. Cumulatively, all lines of coverage will continue to see single-digit rate increases. Commercial Property and Auto will be the main drivers for rate increases.

No one can predict where the market is going. Our mission is to serve as trusted, knowledgeable partners so our clients can navigate any challenges and opportunities on the horizon. Trends come and go, but partnership endures in an ever-evolving insurance landscape.

While the insurance marketplace over the last five years may feel worrisome to most buyers, the last sustained hard market occurred in the 1980’s. Businesses have enjoyed stable premiums across most lines of insurance for several decades. While we are forecasting premiums to increase at a slower pace than the previous year, this hard market has been relatively short in the grand scheme of things.

At a glance, here is important context around today’s market drivers:

- Property: In large part, inflation, building valuations, reinsurance costs, and a frequency trend of severe catastrophic losses are impacting the property insurance marketplace.

- Most reinsurance treaties renew on January 1st or July 1st. The majority of reinsurance treaties have been relatively mild for 2024. This should stabilize premium increases for 2024.

- Adequate property values will be top of mind for underwriters. We will continue to see tremendous scrutiny to ensure values are set appropriately in 2024.

- We continue to see an increase in the frequency and severity of catastrophic events. Carriers are getting smarter and are modeling for severe CAT exposures (severe convective storms, tornados, hail, wind, etc.), therefore, building in additional rate components to take in these circumstances.

- Risk Improvement. Underwriters are often asking, how has this risk profile or asset improved since last year? Policyholders should spend time with their broker on how the risk quality of the portfolio has improved.

- Workers’ Compensation: The rate environment in most states is expected to remain very competitive for both guaranteed cost and loss-sensitive programs.

- Cyber: “Cyber hygiene” is here to stay. Stringent underwriting requirements around data security have positively impacted insureds’ risk profiles. Rates are expected to be flat to +15%.

- Auto: Virtually all auto liability insurers will push for rate increases in 2024. Large auto insurers have strategically exited poorly performing states or left the marketplace entirely, leaving buyers with limited options. Underwriting results in 2022 plummeted with a combined ratio of 105.3%. Both large fleet operators and private passenger risks continue to post negative claim performance driven by inflation, nuclear verdicts and settlements, continued supply chain disruption, vehicle repair due to inflation, and heightened litigation financing. We anticipate rates to continue to increase from +8% to +15%.

How Can CCIG Help?

The CCIG team has the extensive experience and innovative mindset necessary to create strategic solutions in a complex environment.

Here are just a few ways we can support you:

- Start the renewal process early – let’s make sure you have adequate time to evaluate all possible options, ensuring you implement the program approach that fits your needs.

- When it makes sense for your program, we can explore captive solutions.

- Determine your optimal program structure (limits, retentions, etc.) with our industry-leading suite of analytics and benchmarking tools.

- Engage with CCIG’s Safety, Loss Control, and Claims Advocacy teams throughout the year.

- Leverage our industry relationships by asking primary insurers for options, including multiple retention options.

CCIG operates on four essential principles: Relationships, Innovation, Strategy, and Excellence. Those four pillars guide us no matter how the market behaves. It’s why our clients confidently move forward despite industry headwinds, bolstered by the knowledge that they are strategically positioned for success.

Andrew Mahoney

President, CCIG

Email: andrew.mahoney@thinkccig.com

Employee Benefits

Is January 1 the Best Health Plan Renewal Date for Your Business?

A significant majority of employers renew their health plans on January 1 each year without stopping to consider if it is the best option.

Let’s dive into the topic of selecting a plan anniversary: considerations, pros and cons, and the process for changing to a date that better aligns with your natural business cycles.

Taylor Rogers

Executive Vice President, CCIG

Email: taylor.rogers@thinkccig.com

Business Insurance

Nested Protections: Decoding the Dynamics Behind Insurance and Reinsurance

In the intricate world of financial risk management, insurance and reinsurance companies play a pivotal role in safeguarding individuals and businesses against unexpected challenges.

The July 2023 renewals saw U.S. property catastrophe reinsurance rates increase by as much as 50 percent. But it’s not all doom and gloom – January 2024 renewals brought stabilized prices, more favorable terms, and a return to balance in supply and demand.

Paul Plaksin

Executive Vice President, CCIG

Email: paul.plaksin@thinkccig.com

Private Client

Rebuild Reality Check: Understanding the True Cost of Rebuilding a Home

One common misconception is that the rebuild cost is tied to your home’s market value, and they are actually entirely separate. Market value is what you could sell it for, but the rebuild cost? That’s what it’ll take to put the bricks back together.

Even if your home isn’t in a catastrophic risk area, it’s better to be fully prepared and understand your coverage. The last thing you want in an emergency situation is to find out your coverage falls short of what you need.

Andy Orlando

Senior Vice President, CCIG

Email: andy.orlando@thinkccig.com

Workplace Safety & Compliance

OSHA’s New Rules: Electronic Recordkeeping Just Got Trickier

New in 2024, OSHA requires certain employers to electronically report detailed information on the 300 Log and 301 Form by March 2, 2024.

Additionally, the agency will make the information submitted electronically readily available to the public. Public access to the information is particularly troubling for employers, as previously private information concerning a company’s injuries and illnesses will now be available to the public, customers, competitors, labor unions, and other interested parties.

2024 OSHA Recordkeeping & Update

Gary Glader

Practice Area Leader of Safety, CCIG

Email: gary.glader@thinkccig.com