Insurance Guide for the Mortgage Industry

Mortgage lenders are no strangers to managing risk. Factors like credit risk, interest rate risk and market risk represent many of the direct threats and profit opportunities within core product lines.

There are operational risk factors, however, that are often entrusted to a third-party insurance broker that present significant opportunities to boost profitability and mitigate potentially disastrous setbacks.

The most successful companies that we work with carefully balance risk and opportunity within their insurance programs, ensuring that they do not waste money over-insuring their risk or expose their company to ruin by failing to adequately prepare for unexpected losses.

Simply put: mortgage companies run their insurance programs the same way they run their core business.

This document is intended to serve as a no-nonsense, plain English guide to help you optimize your organization’s Commercial Insurance and Employee Benefits strategy to boost profitability and mitigate risk.

Insurable Risks

Some common insurable risks for lenders include (but are not limited to):

- Healthcare / Employee Benefits

- General Liability and Commercial Property

- Errors and Omissions

- Cyber Insurance

- Social Media Liability

- EPLI

Employee Benefits

The average IMB allocates 20-25% of their expense budget to employee benefits, with the company health plan driving the majority of this expense.

A health plan designed by a publicly traded insurance company will naturally prioritize their own shareholders, where a health plan designed solely for the benefit of the employer can direct all funds to employee compensation and well-being.

What is “risk” as it relates to the health plan?

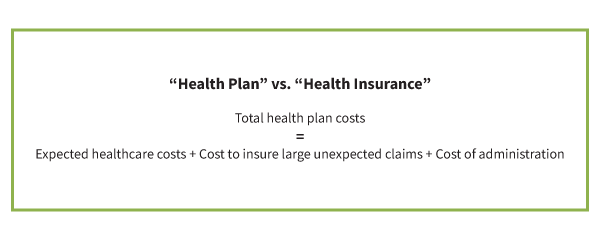

A company’s total health plan risk is simply the total of expected and unexpected healthcare expenses during the plan year. If a plan is suboptimal, they are either:

- Using more healthcare than they could be

- Paying more for healthcare than they should be

- Both the above

Mitigate

A plan should incentivize behaviors that lead to fewer and lower cost claims. Naturally, this goes hand in hand with creating a healthier population.

This means eliminating barriers to care, providing guidance and education around potential therapies, and making it easier and less expensive for members to pursue earlier, more conservative intervention.

Once a plan begins to optimize utilization of predictable and controllable care, we focus on the infrequent, significant, unpredictable losses.

Transfer

Catastrophes and “black swan” diagnoses happen. Sometimes we can improve cost or outcome to reduce the financial liability – sometimes we cannot. In this small percentage of scenarios, it makes sense to transfer the risk via Stop-Loss insurance.

Stop-loss contracts are complicated, with many policy options and bells and whistles to choose from. It is important that you partner with a trusted insurance advisor to help you understand the risk you are retaining and the risk you are paying to transfer.

Please note that there is no free lunch, and we cannot transfer known risk. Large claims that carry over from one policy year to the next will eventually be priced into your contract. To protect against multi-year risk requires thoughtful planning and preparation prior to placing the original contract.

Finance

When you’ve done all that you can to improve utilization, and you’ve successfully transferred any unknown risk beyond your comfort level, you pick up the tab.

Claim financing is no different from any other type of borrowing. The more cash flow protection you require, the higher your financing costs.Risk Management

There are three foundational ways to manage risk. Subsequent sections will address how these three techniques can be successfully applied to boost performance.

- Reduce/Mitigate: The most cost-effective claim is a claim that doesn’t happen. Taking measures to reduce the frequency and severity of losses will yield better terms in the form of lower premiums and greater coverage.

- Transfer: The purpose of insurance is to transfer financial liability associated with an unexpected or low-probability scenario. Insurance products are priced such that $1 in premium will always represent less than $1 in expected claim payments. For this reason, it makes sense to retain smaller, more predictable losses, and purchase insurance only for costly low-probability losses.

- Finance: For significant known or expected losses, how a company chooses to pay for the losses can significantly impact cash flow and the total cost of remediation.

Business Owner’s Policy

- A business owner’s policy (BOP) bundles general liability insurance with commercial property insurance. It typically costs less than if the policies were bought separately.

- A BOP covers common risks and business property.

- A Business owners policy protects Mortgage Professionals from third-party liabilities and property damage by combining General Liability Insurance and Property Insurance. Since mortgage industry jobs are typically low-risk, your business may qualify for a BOP.

Errors & Omissions Insurance

- Errors and omissions insurance (E&O) helps cover the cost of a lawsuit if a client claims your work was inaccurate, late, or never delivered. It’s sometimes called professional liability insurance.

- E&O protects against mistakes and oversights

- An error on a title or an oversight in closing documents could lead to a lawsuit. Whether you are sued by a litigious client or you’ve made a genuine mistake. Errors and omissions Insurance can help cover legal costs that might otherwise impact your business.

- This policy provides liability coverage related to:

- Accusations of negligence

- Professional mistakes

- Failure to deliver promised services

- E&O protects you from client accusations, whether or not you're to blame. It's a key policy for mortgage professionals – and it's even required for brokers in some states.

Cyber Insurance/Social Media Liability

- Cyber liability insurance, also called cybersecurity insurance, protects small businesses from the high costs of a data breach or malicious software attack. It covers expenses such as customer notification, credit monitoring, legal fees, and fines.

- Cyber liability covers breaches in cyber security, and can be endorsed to provide Social Media Liability as well.

- Mortgage businesses handle sensitive customer data and perform sizable transactions. That translates into a high risk of cyberattacks. If electronic data is stolen or compromised, your customers are at risk of theft — including identity theft — and they could sue your company.

- When data is stolen or compromised, Cyber Insurance can cover legal fees and provide vital resources, such as credit monitoring for affected clients.

- Partnership with FRSecure

By partnering with FRSecure, CCIG brings you a compressive cyber security management solution, linking carrier priorities with implementation programs to keep premiums in line with your overall cyber health. FRSecure is a full-service information security consultancy, helping businesses and organizations understand their security risks and how they can make the right decisions, improvements, and investments to mitigate them.

CCIG is a partner and member of The Mortgage Collaborative

About Us

Since 1985, CCIG has been a fiercely independent, rapidly growing insurance brokerage, delivering risk management and insurance solutions to our clients. We represent clients nationally, employ over 100 insurance professionals, and have offices in Denver, CO and Austin, TX. Our Advisors are relentlessly competitive with a specialized focus on better understanding client needs and the evolving industry landscape. We have an award-winning culture fueled by intuitive, proactive colleagues who are focused on building value-add relationships and rooted in excellence.

Our continued outsized organic growth has earned accolades as Max Performer of the Year, and we’re recognized as one of the fastest growing privately held companies in the U.S. The Independent Insurance Agents and Brokers of America has named CCIG the “Best Practices” Insurance Broker multiple times. CCIG lives by the acronym of RISE: Relationships, Innovation, Strategy, Excellence. This is the foundation on which we make every decision.

#RISE

- We are Relationship driven at our core. After all, the value in our business is our people and the people we serve.

- We are Innovative with technology. We have invested in industry-leading technology to provide the highest level of service to our clients.

- We are Strategic. Whether that is how we go to market, or how we proactively help you navigate risk with our Risk Control and Claims teams.

- We are rooted in Excellence. Our focus on Excellence has driven a 95% client retention rate and is measured throughout our company to ensure our service and quality levels are best in class.

CCIG was founded on the idea that a great company is made possible by great people. For 37 years, we’ve attracted and retained industry leaders to provide personalized, forward-thinking insurance solutions. We’ve made significant investments to bring the resources and market access of national and global brokerages to the Texas and Colorado marketplaces.

$187,000,000+

TOTAL MANAGED PREMIUM

95%

CLIENT RETENTION

250+

CARRIER PARTNERS

Taylor Rogers

Executive Vice President

taylor.rogers@thinkccig.com

(512) 422-9269

Taylor’s background in finance enhances his ability to create pathways for his clients to realize better physical and financial outcomes for their employees and benefit plans. After several years in the insurance industry, Taylor specialized in employee benefits to help companies make the strongest decisions in sourcing, funding, and structuring their programs.

By blending his background in finance and insurance, Taylor offers a comprehensive approach to creating employee benefit programs that not only retain talent but also attract top performers. He helps companies enhance their bond with employees with generous benefit offerings that also support the company’s financial and business goals.

Rich Hejny

Executive Vice President

rich.hejny@thinkccig.com

(512) 420-7333

Rich has over a decade of insurance experience, having worked for a national health insurance carrier and a third-party administrator before joining CCIG. Recognizing a wide gap in the traditional model of health insurance, he has spent his career demonstrating that controlling healthcare costs and offering robust benefit plans don’t have to be mutually exclusive.

The first step in Rich’s approach is to truly get to know and understand his clients’ businesses, then create a personalized benefit plan based on the company’s size, financial goals, and internal culture. Rich’s passion for building strong relationships allows him to support companies as they move towards an innovative, tailored strategy designed to strengthen the company.

Testimonials & References

"One of the most impactful things about working with CCIG is that they have the expertise and solutions the mega brokers offer, but you get a personalized experience and a dedicated team. Instead of feeling like you’re on an assembly line, the team takes the time to understand your specialized needs and then crafts a customized risk management plan. That tailored approach sets the CCIG team apart from any other broker I’ve worked with, and it makes a significant difference in how we approach risk management."

"Shifting to CCIG has underscored the potential of working with a boutique insurance team. Many of CCIG’s team members came from big brokers because they wanted to deliver a better, more personalized client experience, and that’s exactly what I’ve seen. They ask the right questions to understand your opportunities and risks and then work alongside you to create a risk management plan that sets the foundation for a strong future."

Client Insights

Because we never stop learning about our clients' unique goals and needs, real innovation is our norm.

Self-Funding: The Future of Employer Healthcare

The self-funded model enables employers to contain costs and financially protect employees.

The Broker’s Role in Controlling the Total Cost of Risk

Your insurance broker has the important job of favorably positioning your business to potential insurers to get you the optimal price.

6 Types of Insurance Your Business Needs

The complexities of running a business can be overwhelming for anyone. Having someone to go through the insurance-buying process can help ensure...